ace listing requirements

Engage an Approved Adviser to assess the suitability for listing. Chapter 5 - foreign listing.

Philips A19 E26 Medium Led Bulb Soft White 60 W 6 Pk Fluorescent Light Bulb Bathroom Light Bulbs White Light Bulbs

A the procedures for admission.

. In order to meet the minimum profit requirements of the Main Market a company has to report an uninterrupted profit after tax PAT of three to five full financial years with an aggregate of at least RM20 million including a PAT of at. These documents contain the Main Market Listing Requirements which have been updated as at the date above and are posted on this website for the publics reference only. Ace market listing requirements.

Under the new regulatory regime Bursa is now a one-stop centre for all ACE Market IPO approvals including the registration of abridged prospectuses for the purpose. To promote board quality and strengthen board independence the enhanced new requirements now limit the tenure of an independent. There is no minimum requirement on the operating history size and.

New Framework For Listings And Equity Fund-Raisings for Main Market. This is where the company. Chapter 2 - general.

Chapter 6 - new issues of securities. And b a principal officer of the listed corporation or its major subsidiary. This is where Bursa Malaysia will rely on the Sponsor and then review the proposal of the company.

Chapter 7 - articles of association. ACE Market Listing Requirements Amended to Facilitate One-Stop Centre for IPOs. Chapter 3 - admission.

Chapter 1 - definitions and interpretation. To facilitate the aforementioned changes the ACE Market Listing Requirements have been amended by Bursa Securities accordingly. You should always refer to these Listing Requirements and Guidance Notes together with any subsequent amendments issued from time to time by Bursa Malaysia Securities.

Listed issuers are presently given a freehand as to how and the order in which they disclose the required information in their transaction announcements and circulars. The company to have paid-up capital approximately RM 5 million to RM 10 million. Key Changes to the Listing Requirement.

Chapter 3 - admission. Chapter 6 - new issues of securities. Sponsorship is for one full FY.

Chapter 1 - definitions and interpretation. Bursa Securities had also in the Joint Media Release announced that certain amendments have been made to the Main Market Listing Requirements the amendments of which are effective from 1 January 2022. The requirements in this Chapter apply to dealings in any listed securities by the following categories of persons collectively referred to as affected persons.

2 If the new issue of securities is pursuant to or will result in a significant change in the business direction or policy of a listed corporation the listed corporation must also comply with the. The requirements relating to contents of a transaction announcement and transaction circular are set out in Appendices 10A and 10B respectively of the LR. The company will need to issue a minimum of 25 of the companys shares to the public.

These documents contain the ACE Market Listing Requirements which have been updated as at the date above and are posted on this website for the publics reference only. ACE Market corporations that have met the Main Market admission criteria. First there is the suitability for listing issue.

No minimum operating track record or profit requirements. A a director of the listed corporation or its major subsidiary. The Securities Commission Malaysia SC and Bursa Malaysia Securities Berhad the Exchange issued a joint media release on 20 December 2021 announcing amendments to the ACE Market Listing Requirements ACE LR to enable the.

Approve application subject to conditions 2. EFFECTIVE Jan 1 Bursa Malaysia became the sole approving authority for IPOs on the ACE Market the second-largest listing platform of the stock exchange and home to 141 public listed companies PLCs. Full Text of the ACE LR GST Amendments.

Chapter 4 - sponsors. This Guidance Note sets out the following requirements in relation to an application for admission under Rule 302 of the Listing Requirements. And c the undertakings and confirmation by an applicant and its directors.

Requirements for ACE Access Certainty Efficiency market. She also explained that unlike the MESDAQ Market the ACE Market allows listing of eligible companies from all sectors instead of only highgrowth or technologybased companies. Chapter 5 - foreign listing.

Secure and maintain a Continuing Adviser for at least 3 years post listing and the Approved Adviser who submitted the listing application must act as the Continuing Adviser for at least 1 FY upon admission. 1 This Chapter sets out the requirements that must be complied with by an applicant or a listed corporation as the case may be for any new issue of securities. Bursa Malaysia Berhad announces the enhanced requirements in the Main and ACE Market Listing Requirements aimed at further strengthening board independence quality and diversity.

If the number of directors of the listed issuer is not 3 or a multiple of 3 then the number nearest 13rd must be used. Listing requirements in the ACE Market. PN Companies Cash Companies and Default in Payment.

PART E REQUIREMENTS RELATING TO A RIGHTS ISSUE 618 Additional requirements 619 Underwriting 620 Requirements in relation to two-call rights issue 621 A rights issue must be renounceable 622 Fixing of books closing date for a rights issue 623 Notice of books closing date for a rights issue 624 Timetable for a rights issue. Chapter 2 - general. B the listing application form and supporting documents.

Chapter 4 - sponsors. ACE MARKET PART I ADDITIONAL REQUIREMENTS RELATING TO AN ISSUE OF CONVERTIBLE SECURITIES 650 Requirements relating to convertible securities 651 Maximum number of new shares allowed from exercise of warrants 651A Bonus issue of warrants 652 Holders of convertible securities. Engage listed issuers and Prescribed Listing form advisers to rectify areas of Concurrent.

Chapter 7 - articles of association. Amendments to Bursa Malaysia Securities Berhad ACE Market Listing Requirements and Fees and Charges for the ACE Market Consequential to the Repeal of the Goods and Services Tax Pursuant to the Goods and Services Tax Repeal Act 2018. New Fund Raising Framework All relevant requirements relating secondary issuance as stipulated in the SCs Guidelines on the Offering of Equity and Equity-Linked Securities are now incorporated in the Main LR Listing Application Bursa may.

If you intend to have your company listed in the ACE Market there are several factors that must be considered. Pursuant to Rule 1502 1 of the Listing Requirements a listed corporation must ensure that at least 2 directors or 13rd of the board of directors of the listed corporation whichever is the higher are independent directors. Ace market listing requirements.

Logo Design For Desert Ace Logo Design Business Logo Design Logo Design Feminine

Ace Market Enters A New Regulatory Regime The Edge Markets

Sellers Disclosure Pa A Guide To Ace Your Disclosure Process

![]()

Start A Ace Hardware Franchise In 2022 Entrepreneur

Browse Unique Items From Theshinedesignstudio On Etsy A Global Marketplace Of Handmade Vint Resume Design Resume Template Professional Resume Design Template

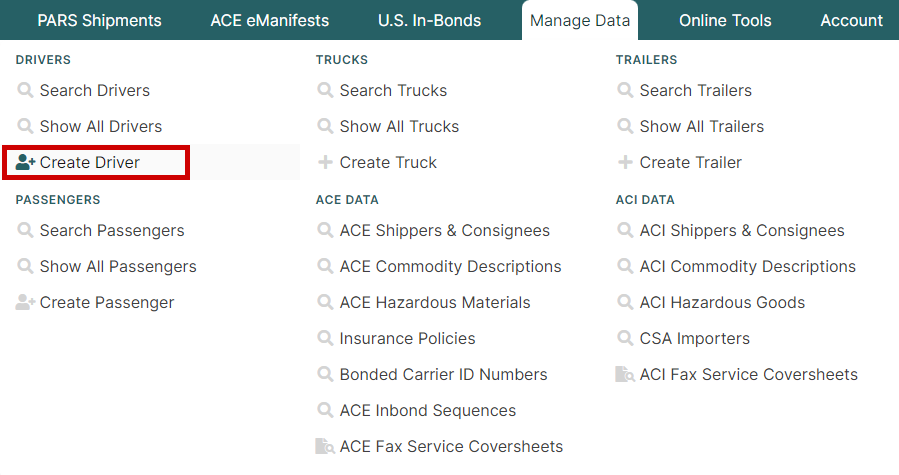

Creating And Maintaining Driver Profiles Ace And Aci Emanifest Borderconnect

Meal Planning For Kids Updated Kids Meal Plan Kids Nutrition Critical Thinking

Bursa Listing Requirement Guides Isquare Intelligence

Light Green Retro Tennis Sticker Pack Sticker By The Goods In 2022 Cute Laptop Stickers Green Sticker Tennis

Listing Your Company On Bursa Malaysia Ipos In 2021

Pin On Virtual Assistant Services

Comments

Post a Comment